The Florida Office of Insurance Regulation (OIR) has established the 2019personal and commercial property insurance rates for Citizens Property Insurance Corporation (Citizens).

On June 19, Citizens announced that their Board had approved revised 2019 rates to reflect the projected impact of Assignment of Benefits (AOB) reforms enacted during the 2019 Legislative Session. OIR has reviewed these filings and considered the comments and testimony received from policyholders and other interested parties, both by email and during a public rate hearing held on March 14, 2019, in Miami, FL.

As a result of this review, OIR has established the rates for Citizens personal and commercial property accounts. The Orders can be accessed here: Personal Property Order, Commercial Property Order. The effective date of the proposed rate changes for all three accounts (Coastal, Commercial Lines, and Personal Lines) is December 1, 2019.

Commissioner Altmaier said: “We are pleased to see that AOB reforms passed by the legislature are already having a positive effect on rates. We will be closely monitoring new rate filings to ensure that costs savings are passed along to Florida consumers.”

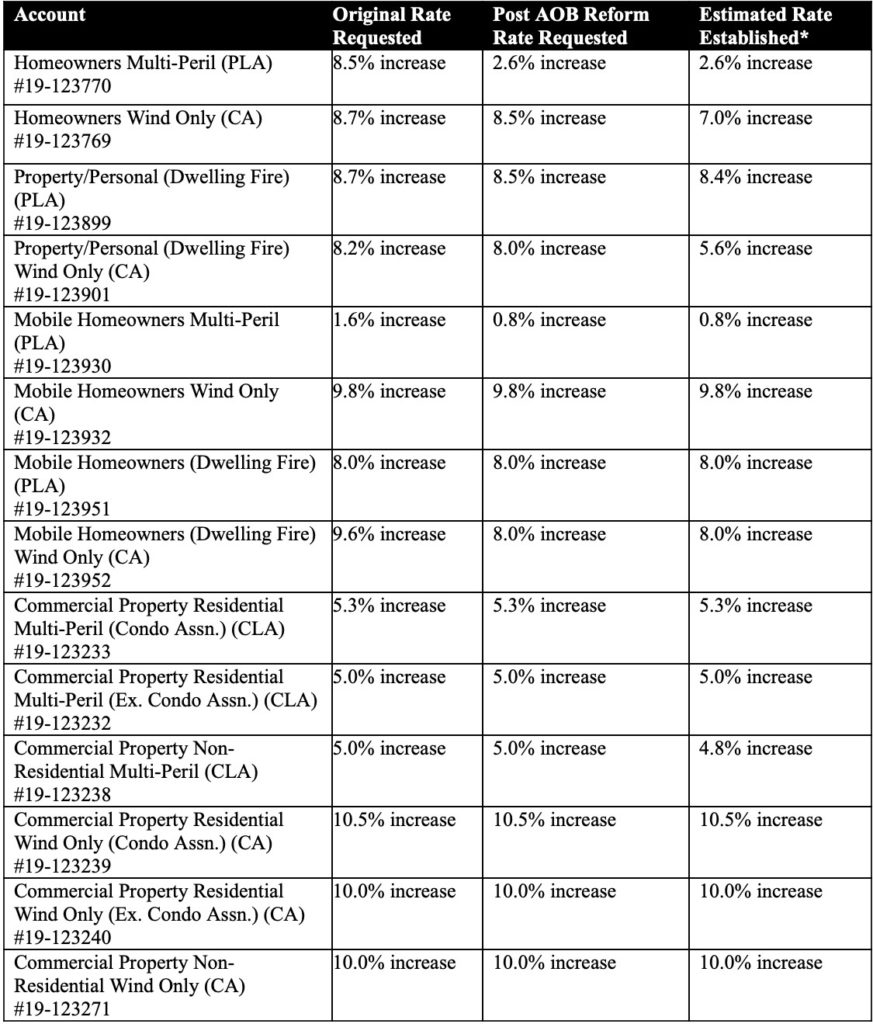

The chart below provides the overall estimated statewide average rate changes established by the OIR for each line of business individually and highlight the impact of AOB reform on requested rates:

* This is an estimate of the rate effect on earned premiums determined using selected changes from the in-force policy distributions and the rates in the Order.

These filings can be accessed via the “IRFS Forms & Rate Filing Search” system using the following search criteria: file log numbers (provided below) or by entering Citizens as the “company name” (and scrolling down to the bottom of the results page for the most recent filing information).

Visit the Citizens Public Rate Hearing webpage on the OIR’s website for additional information.

About the Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation has primary responsibility for regulation, compliance and enforcement of statutes related to the business of insurance and the monitoring of industry markets. For more information about OIR, please visit our website or follow us on Twitter @FLOIR_comm.