Legislature answers Governor’s call to action to combat government- and corporate-sanctioned activism and the environmental, social, and corporate governance (ESG) movement

Governor Ron DeSantis signed comprehensive legislation to protect Floridians from the corporatist environmental, social, and corporate governance (ESG) movement — a worldwide effort to inject woke political ideology across the financial sector, placing politics above the fiduciary duty to make the best financial decisions for beneficiaries. Today’s announcement follows through on the Governor’s proposal announced earlier this year. Additional information on the legislation can be found here:

“In Florida and across the nation, we’ve heard from law-abiding small business owners and consumers who’ve been denied access to financial services because of where they work or what they believe in,” said Governor Ron DeSantis. “Through this legislation, Florida will continue to lead the nation against big banks and corporate activists who’ve colluded to inject woke ideology into the global marketplace, regardless of the financial interests of beneficiaries.”

“Just as the Governor fought Fauci — and won — he’s fighting a WOKE-Wall Street that looks down upon every-day Americans,” said Chief Financial Officer Jimmy Patronis. “WOKE-Wall Street wants to cozy up to the CCP and Dylan Mulvaney! Left wing media can hate Florida all they want, but under Governor DeSantis’ leadership, people are leaving Blue States in droves! Our stance against ESG is another signal to the rest of the world that Florida believes in prosperity, we believe in freedom, and we’re a place where WOKE GOES TO DIE!”

“Florida will not bow down to the political virtue signaling of martini millionaires,” said House Speaker Paul Renner. “Corporations have no right to bypass our democratic process. Companies that engage in ESG hurt their customers and the communities they serve, including Florida’s retirees, by making everything they produce more expensive. ESG undermines our national security and bypasses our democratic process. I applaud Governor DeSantis for standing up to corporate titans who believe they are a law unto themselves and protecting Florida’s hardworking families.”

“Speaker Renner and Governor DeSantis have been leaders in creating public awareness of this critical issue and crafting concrete steps Florida can take to protect the retirement funds of state and local employees by guarding against misguided and discriminatory ESG policies,” said Senate President Kathleen Passidomo. “We all want our state employees and local employees — including many classrooms teachers and law enforcement officers who are part of the state retirement system — to have a strong retirement they can count on. With this legislation, we are going to make certain that state funds are managed to prioritize the highest return on investment, as our retirees and taxpayers expect.”

Today’s announcement serves as a blueprint for the nearly 20 states who’ve joined an alliance led by the Governor to push back against the proliferation of ESG through taking similar actions in their home states. The same cannot be said in Washington, where President Biden issued his first veto against legislation to institute similar protections for federal retirement funds, putting retirement savings of hardworking Americans, including our veterans, at risk.

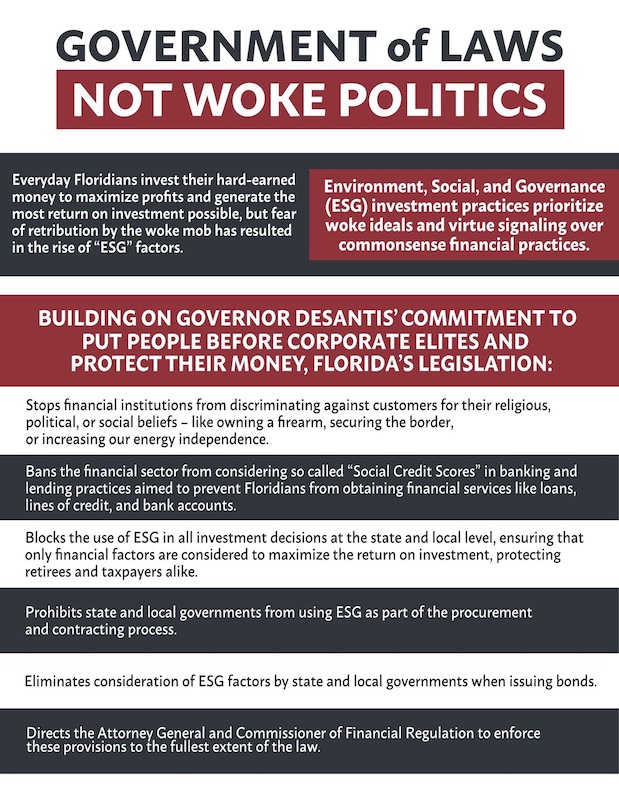

House Bill 3 combats government and corporate sanctioned activism by:

- Codifying actions taken by the State Board of Administration at Governor DeSantis’ direction to ensure that all investment decisions must be driven solely by pecuniary factors and may not sacrifice investment returns to promote factors like ESG and extending these requirements to all state and local funds;

- Prohibiting the use of ESG factors by state and local governments when issuing bonds, including a contract prohibition on rating agencies whose ESG ratings negatively impact the issuer’s bond ratings;

- Prohibiting all state and local entities from considering or giving preference to ESG as part of the procurement and contracting process;

- Prohibiting banks that engage in corporate activism from holding public deposits as a Qualified Public Depository (QPD);

- Prohibiting financial institutions from discriminating against customers for their religious, political, or social beliefs — including their support for securing the border, owning a firearm, and increasing our energy independence;

- Prohibiting the financial sector from considering so-called “Social Credit Scores” in banking and lending practices that aim to prevent Floridians from obtaining loans, lines of credit, and bank accounts; and

- Directing the Attorney General, Chief Financial Officer, and Commissioner of Financial Regulation to enforce these provisions to the fullest extent of the law.

These legislative accomplishments codify actions taken by Governor DeSantis and his fellow trustees of the State Board of Administration (SBA) to remove any ESG considerations from state investment decisions, ensuring that all investment decisions focus solely on maximizing the highest rate of return. The full text of the resolution stipulating that state investment managers may not sacrifice investment return or take on additional investment risk to promote any non-pecuniary factors can be found here.